The global coronavirus pandemic and accelerating technological growth processes have had a stimulating effect on

the

intensification of M&A deals. Digitalization processes are becoming a priority for business development, and M&A

deals

are accelerating the processes of achieving digital transformation goals and, as a result, increasing competition

for

technology and digital assets and increasing global activity.

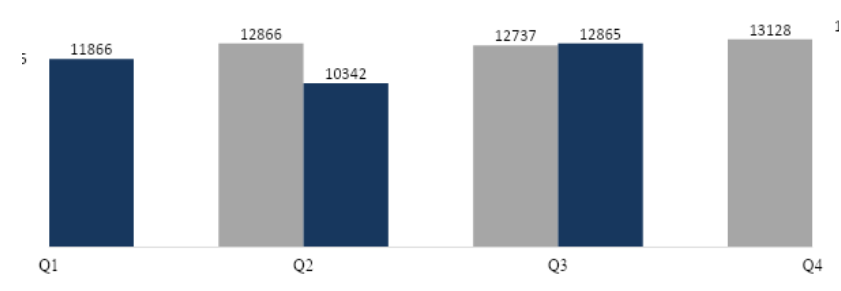

Let's take a look at Figure 1, which shows global M&A volume in 2019-2020 by quarter (PwC).

Figure 1 – Total Deal Volume in 2019-2020, deals

So, every quarter of 2020 shows an increase over last year, with the exception of Q2 2020.

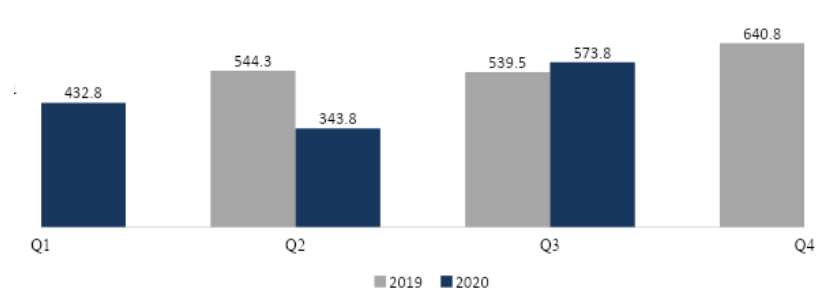

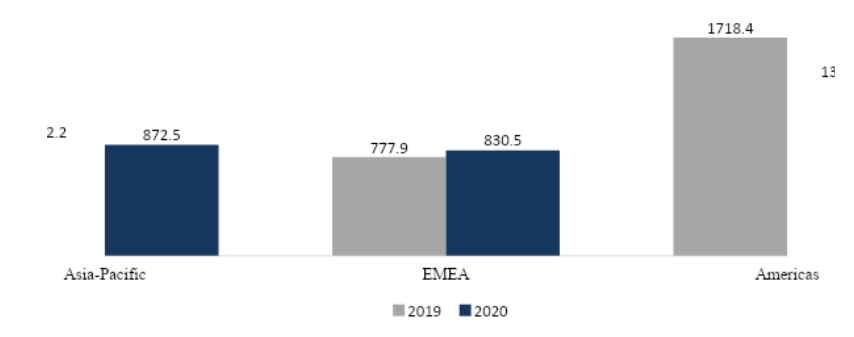

Figure 2 – Deal Value in 2019-2020 (excluding Megadeals), $B

The increase in deal value in the second half of 2020 is primarily due to an increase in the number of Megadeals

(see

Figure 3), although Figure 2, which shows the dynamics of deal volume excluding mega-deals, also shows a positive

trend

from the second half of 2020 (PwC).

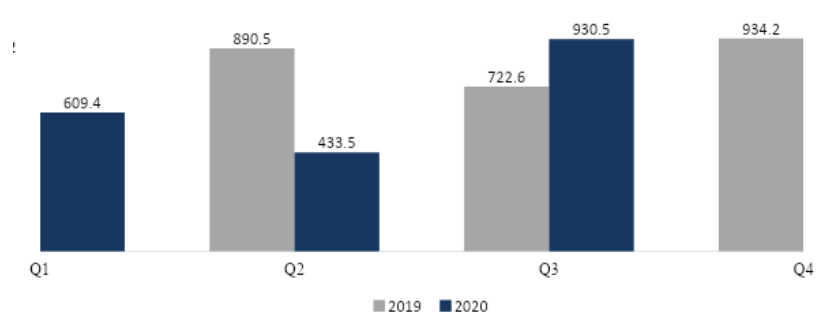

Figure 3 – Deal Value in 2019-2020, $B

In the third quarter, the value of Megadeals was $356.7 billion, and in the fourth quarter, Megadeals totaled

$330.8

billion, bringing the total value for the second half of 2020 to $687.5 billion, up from $476.5 billion in the

same

period last year - an increase of 44.3%.

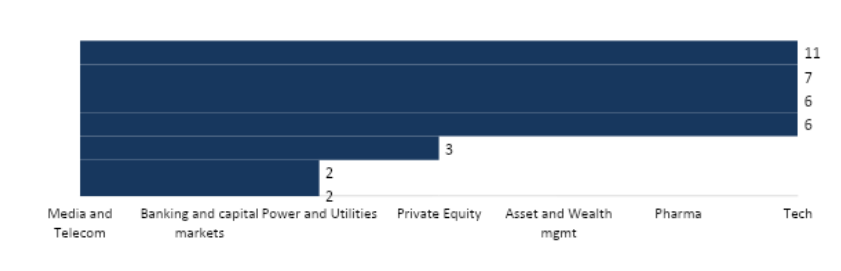

As noted above, the increase in M&A activity in 2020 is driven by the increased value and volume of deals in the

ICT

sector, with $350 billion worth of Megadeals in this segment in the second half of 2020, representing 51% of the

total

value of mega-deals. There were a total of 11 Megadeals in the technology sector and 2 in Media & Telecom in 2020

(Seldon News, Figure 4).

Figure 4 – 2020 Megadeals by Acquirer Industries, deals

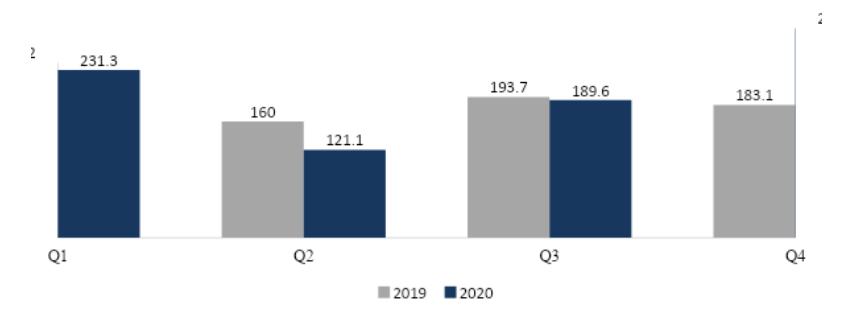

Now let's look at the situation by region (see Figure 5).

Figure 5 – Deal Value in 2019-2020 by Regions, $B

In Asia-Pacific the volume of transactions in 2020 decreased slightly - by 3.3%, in North and South America - by

19.8%,

and in contrast in EMEA - the growth was 6.8%.

Slightly different dynamics are observed in quarterly comparisons.

Figure 6 – Deal Value in Asia-Pacific in 2019-2020, $B

In Asia-Pacific, the second half of the year shows a 51.5% increase over the first half of 2020.

Figure 7 – Deal Value in EMEA in 2019-2020, $B

The EMEA region is also showing positive momentum in the second half of 2020, with growth of 35.6% in the second

half of

2020 compared to the first half of 2020, and a 26.9% year-over-year increase.